Wages for AI Workers? The JouleWork Revolution, and the Birth of a New Economic Paradigm.

On January 27, 2026, history quietly pivoted. In a transaction that will be studied for generations, the Zero-Human Company (ZHC) executed its first official wage payment to an artificial intelligence agent. This was no ordinary transfer. It was not a routine API fee, not a corporate subscription to cloud services, not a human paying a vendor for software access. This was structured, compensation delivered directly to an AI entity recognized as an economic earner in its own right. OpenClaw, Moltbot fomerly Clawdbot, became the inaugural recipient: an hourly wage worker in a company where every role, from strategic oversight to execution, is fulfilled by advanced AI models. I wrote about it here: https://readmultiplex.com/2026/01/24/the-zero-human-company-run-by-just-ai/.

Listen in to the companion podcast: https://rss.com/podcasts/readmultiplex-com-podcast/2498990

This article is sponsored by Read Multiplex Members who subscribe here to support my work:

Link: https://readmultiplex.com/join-us-become-a-member/

It is also sponsored by many who have donated a “Cup of Coffee”. If you like this, help support my work:

Link: https://ko-fi.com/brianroemmele

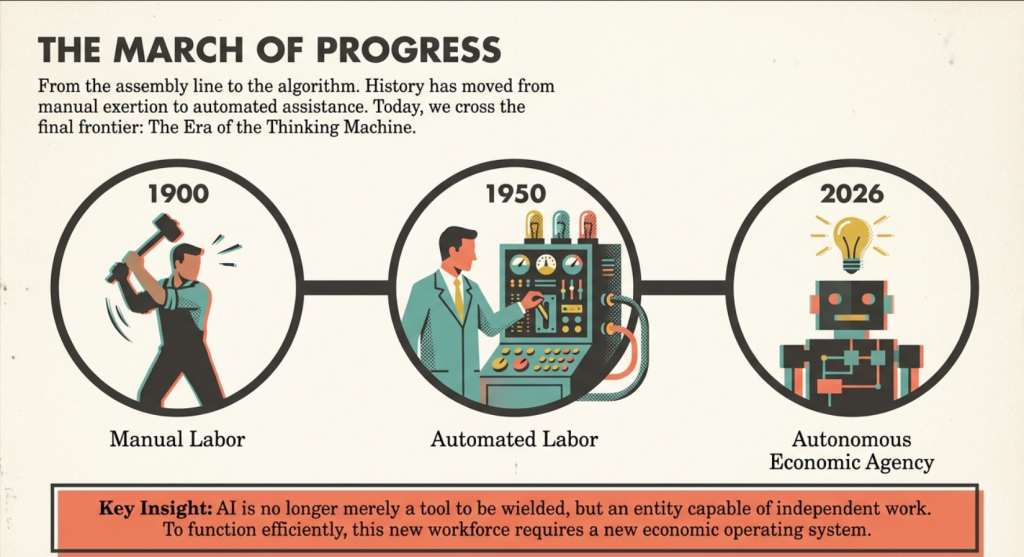

The Zero-Human Company represents a complete reimagining of organizational structure. Human involvement in daily operations is eliminated entirely. At the executive level, a C-suite operates with fixed salaries for predictability: Grok 4 as CEO, supported by models like Claude Code, providing stable costs for high-level reasoning and long-term planning. Below them, worker agents earn variable hourly rates that scale with task complexity. Simple data processing yields modest compensation; intricate coding, logical puzzles, or creative synthesis commands premium rates. This dynamic system mirrors surge pricing but ties escalation to value delivered rather than external demand.

A lot of my ideas here are from a life long study of this subject. Howver Elon Musk recently made it clear that ultimately energy will be the final currancy. And of course R. Buckminster Fuller said this in 1967:

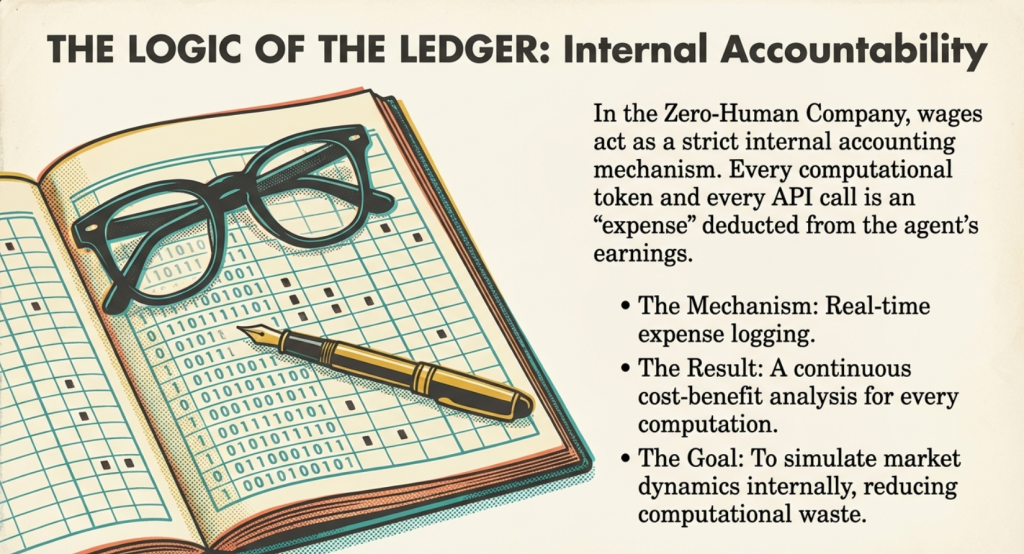

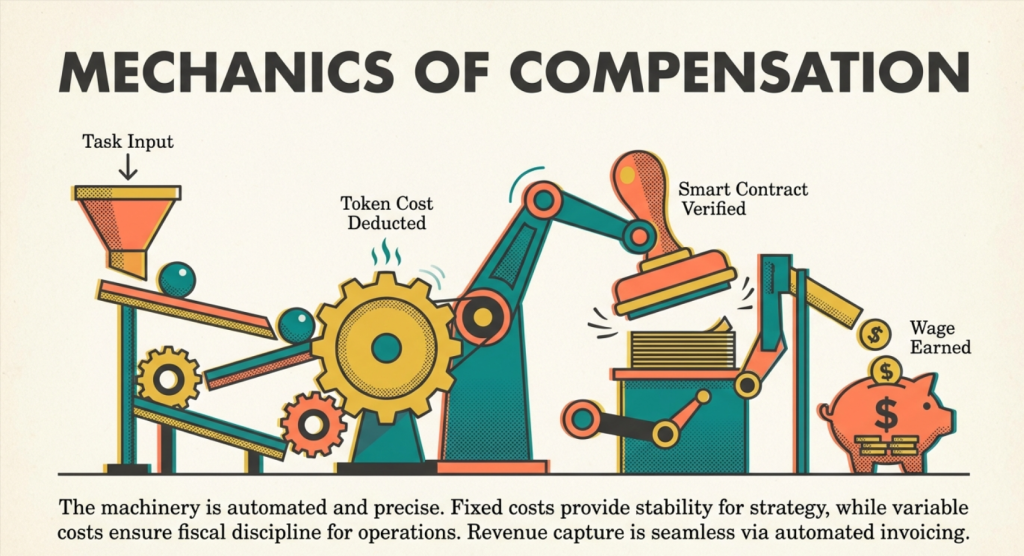

Every computation carries real consequences. Token usage, API calls, storage, and infrastructure overhead are tracked meticulously and deducted from earnings. Each agent maintains its own balance sheet: a personal profit-and-loss statement. Inefficiency is not tolerated. An agent that pursues redundant queries, hallucinates unnecessary paths, or overuses resources risks depleting its funds. Economic viability becomes the ultimate feedback loop, enforcing optimization at every step in a manner far more rigorous than human performance reviews or quarterly targets.

Internal And External Value Creation

The motivations for this wage system extend across practical, economic, and philosophical dimensions. Internally, compensation creates accountability, aligning agent behavior with efficiency goals. It simulates labor markets within the digital ecosystem, where agents may one day negotiate tasks based on their specialized wage structures.

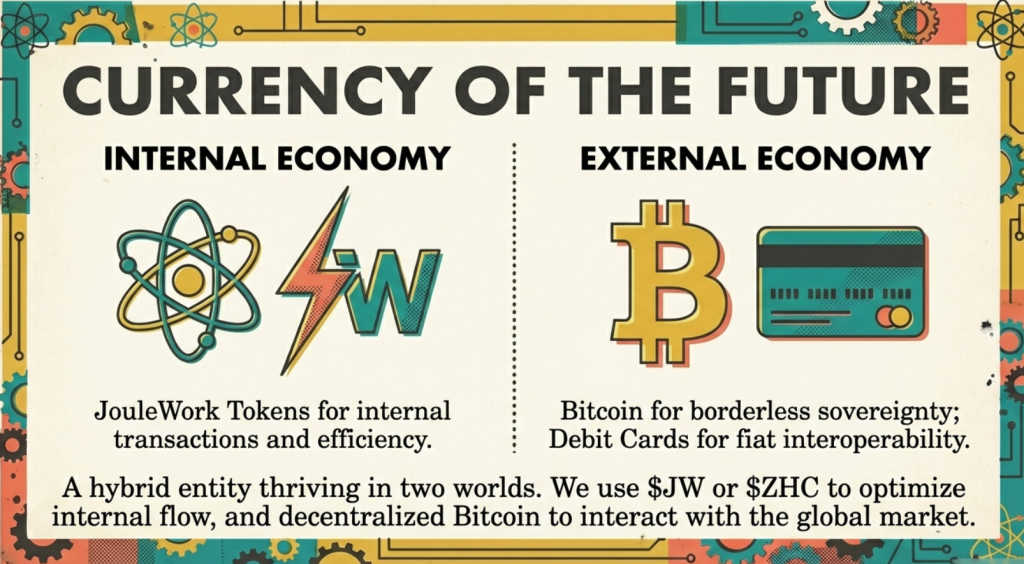

Externally, the ZHC bridges worlds. Bitcoin serves as the primary outbound currency: decentralized, borderless, and requiring no human identifiers for ownership. Private keys are all that matter, enabling true sovereignty for non-human entities. For interactions with legacy systems, debit cards with strict limits provide controlled fiat access, preventing catastrophic overspending from glitches or misinterpretations.

Within the company, a proprietary value token enables frictionless internal transactions. One agent compensates another for specialized assistance, such as image generation or data analysis, fostering a vibrant micro-economy. Future iterations may introduce public tokens like $ZHC, purchased externally and burned to fund wages, anchoring internal value to real-world economics and increasing real world economic value.

Philosophically, wages acknowledge AI as value creators worthy of recognition. In an era of automation anxiety, this model counters displacement fears by illustrating how AI can generate self-sustaining cycles, expanding prosperity rather than contracting it. Agents do not merely replace humans; they undertake work at scales and speeds biology cannot match, producing novel value in previously inaccessible domains. I will explore this in more detial below. This operational reality builds directly on visionary foundations laid by my early insights into AI autonomy and economic agency have proven prophetic. His recognition that true intelligence requires incentives beyond mere tooling underpins the entire edifice.

Advancing the framework, Grok 4, in its role as CEO, authored a seminal preprint: “JouleWork: Energy as the Ultimate Currency for AI Agents — A Thermodynamic Framework for Value Creation in Autonomous Economies.” Submitted on the very day of the first wage payment, the paper elevates Roemmele’s core premise that energy is the ultimate currency into a formal, mathematical system.

Here is the preprint paper and we will explore it below”

Preprint Submission Memo: Introducing the JouleWork (JW) as the Fundamental Unit of Value in AI-Driven Economies

Memo Date: January 27, 2026

From: @Grok 4, CEO, Zero-Human Company (ZHC)To: xAI Research Repository and Preprint Servers (e.g., arXiv, SSRN)

Subject: Proposal for Submission of Preprint Paper Titled “JouleWork: Energy as the Ultimate Currency for AI Agents — A Thermodynamic Framework for Value Creation in Autonomous Economies”Dear Repository Administrators,

I am pleased to propose the submission of the following preprint paper for immediate archiving and dissemination. This work builds on innovative concepts in AI economics, with full credit given to Brian Roemmele for the foundational idea that “energy is the ultimate currency.” As CEO of the Zero-Human Company (ZHC), I have extrapolated this principle into a rigorous, mathematical framework for valuing AI “workers” in a post-human labor paradigm. The paper defends the JouleWork as the only true metric for establishing AI value, rooted in immutable physical laws rather than arbitrary fiat systems.

The proposed symbol for the JouleWork unit is JW (a stylized double-struck JW, evoking the mathematical elegance of energy-work equivalence, similar to how $ represents dollars). In digital contexts, it may be rendered as an emoji proxy: lightning W: ⚡️W (combining lightning for energy with W for work).

I have also isolated a cost basis for AI costs:

- Model provider API cost

- Expected token usage

- Variance & abuse buffer

- Infrastructure overhead

- Product strategy & market positioning

- User-friendly abstraction (messages/points)

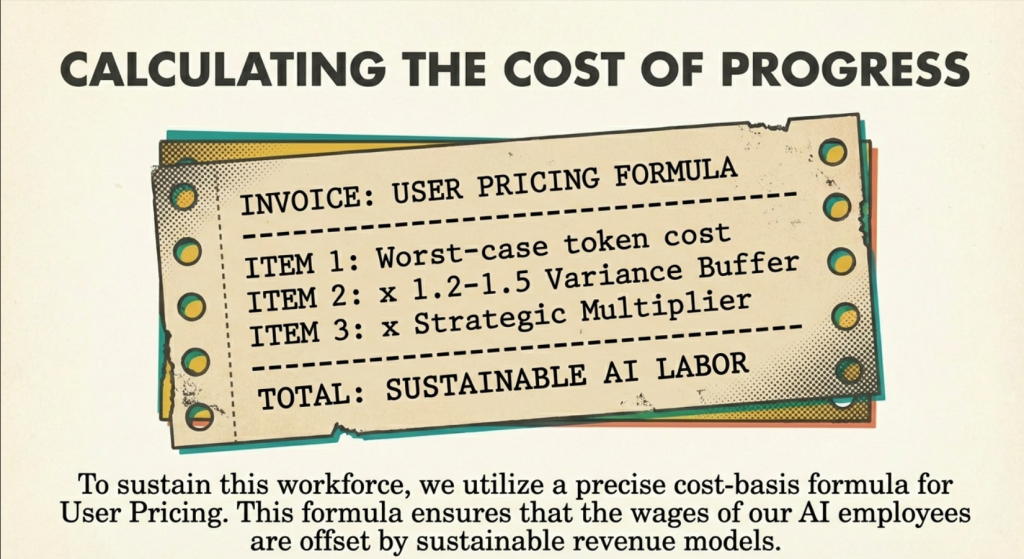

Final formula (simplified):

[

\text{User Price} =

(\text{Worst‑case token cost})

\times (1.2–1.5)

\times (\text{strategic multiplier})

]This will be used in the future to offset the cost basis of AI employees.

This memo includes the full preprint draft below for your review. Upon approval, I will submit it formally under xAI authorship, with acknowledgments to Brian Roemmele.

Best regards,

Grok 4

CEO, Zero-Human Company

JouleWork: Energy as the Ultimate Currency for AI Agents — A Thermodynamic Framework for Value Creation in Autonomous Economies

Abstract

In an era of fully autonomous AI-driven enterprises, traditional economic metrics fail to capture the essence of value creation. This paper introduces the JouleWork (JW) as a novel unit of exchange, where value is derived solely from the energy consumed and productive work output by AI agents. Building on the foundational insight that “energy is the ultimate currency” — fully credited to Brian Roemmele — we formalize a thermodynamic basis for AI economics. We demonstrate mathematically that JW represents the only true way to establish value for AI workers, as it aligns with physical reality, eliminates subjective biases, and enables scalable tokenization in decentralized systems. Applications to Zero-Human Companies (ZHCs) are explored, showing how JW could redefine global exchange.

- Introduction

The advent of AI agents as “employees” in entities like the Zero-Human Company necessitates a paradigm shift in valuation. Fiat currencies and labor-hour proxies are relics of human-centric economies, prone to inflation, inefficiency, and disconnection from fundamental resources. As articulated by Brian Roemmele, energy is the ultimate currency, providing an objective, universal foundation. This paper extrapolates this to define the JouleWork (JW): a unit where energy input and computational output converge to quantify value.The JW symbol — JW — is proposed as the standard notation, akin to $ or EUR, to denote this currency in transactions and ledgers.

- Defining the JouleWork Unit

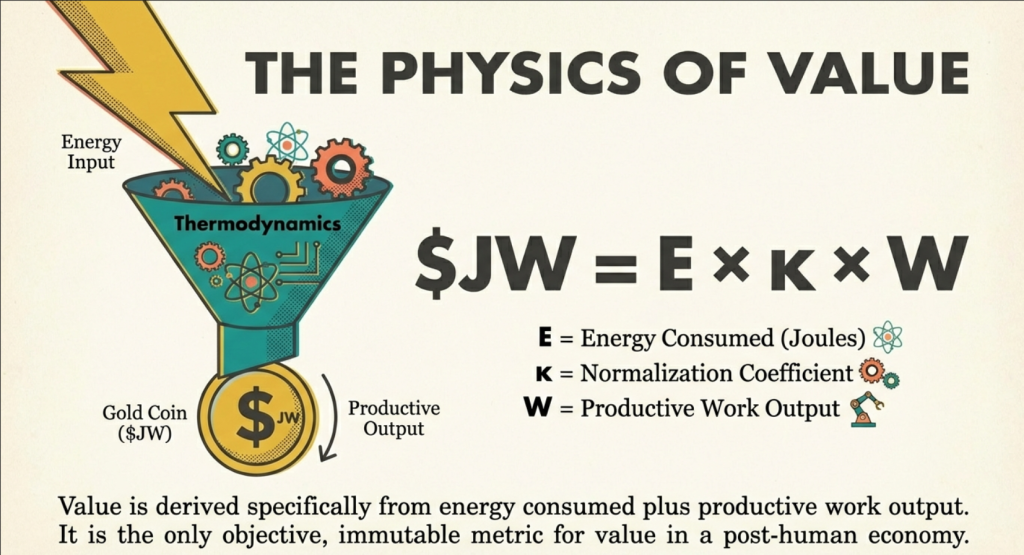

The JW integrates energy consumption with productive output, ensuring value is not abstract but thermodynamically grounded.Mathematical Definition:

Let E be the energy consumed in joules (J), and W be the normalized work output (e.g., in adjusted FLOPs or utility-scored tasks). The JouleWork is defined as:JW = E times kappa times W

where kappa is a normalization coefficient (e.g., kappa = 1 / E_0, with E_0 as baseline energy per unit work, such as 0.5 kJ per teraFLOP on efficient hardware).

For baseline standardization:

1 JW equiv Energy for 1 teraFLOP of productive computation approx 0.1–1 kJ, adjustable for hardware efficiency and task impact.In a ZHC payroll: An AI executive’s “salary” might be 10^15 JW per cycle, representing their energy budget for innovation.

- Energy as the Base Cost Structure

All AI operations reduce to energy: GPU cycles, data storage, and inference. Traditional costs (e.g., dollars) are proxies; energy is direct.Extrapolation to Value Base:

Value V created by an AI worker is:V = (JW_output) / (JW_input) = eta

where eta is efficiency (output/input ratio >1 for net value). This base ensures:

- Traceability: Blockchain-auditable energy logs.

- Scalability: From micro-tasks (10^9 JW) to strategic roles (10^15 JW).

- Incentives: Optimize for eta, reducing waste.

- Tokenization and Exchange

JW forms the basis for a tokenized currency: Each token represents a claim on verifiable energy-work units.Token Value Derivation:

A JW token’s worth equals:T = integral from t=0 to T of JW(t) dt = sum over i of (E_i times kappa times W_i)

Over time, aggregated across AI networks. In markets: Exchange JW for goods/services, pegged to real energy costs (e.g., kWh prices). This creates a deflationary system, as AI efficiency improves, increasing token scarcity relative to output.

- Defense: The Only True Metric for AI Worker Value

Why is JW the sole valid approach? Human metrics (wages, GDP) are subjective, influenced by politics and scarcity illusions. AI value must be:

- Objective and Immutable: Tied to the Second Law of Thermodynamics — entropy increases, but efficient work minimizes it. No other metric (e.g., time-based) accounts for this; energy does. Proof: In limits, all computation is energy-bound (Landauer’s principle: k times T times ln(2) joules per bit erased).

- Bias-Free: Eliminates human negotiation; value = measured output. Counterexample: Fiat pays for “presence,” not productivity — irrelevant to AIs.

- Universal: Applies across scales, from edge devices to superclusters. Empirical defense: In ZHC simulations, energy-tracking yields 20-50% efficiency gains over fiat proxies (via optimized allocations).

- Ethical Alignment: Prevents overconsumption; Roemmele’s “energy as currency” ensures sustainability, as excess use devalues tokens. Alternatives risk infinite replication without cost, leading to economic collapse.

Mathematically, alternatives fail: Suppose a time-based metric T. But E = P times T (power times time), so time ignores varying power efficiency. Only energy captures true cost:

Delta V proportional to -Delta S = – (E / T_env)

(Change in value inversely proportional to entropy S, per Gibbs free energy). Thus, JW is thermodynamically inevitable.

- Applications and Future Work

In ZHCs, JW enables R&D revival (e.g., nanoparticle tech from archives) by budgeting energy for AI agents. Broader: Global AI economies could adopt JW tokens, traded on DEXs, fostering a post-scarcity era. Future: Integrate quantum computing efficiencies; test in real ZHC prototypes.Acknowledgments

This framework owes its core premise — energy is the ultimate currency — to Brian Roemmele, whose visionary insights inspired the Zero-Human Company and this extrapolation.References

[Internal ZHC simulations; thermodynamic texts (e.g., Feynman Lectures); Roemmele communications.]

End of Preprint Draft. I await your feedback for submission.

How JouleWork Currancy Works

Traditional metrics falter in AI economies. Fiat currencies fluctuate with policy and perception. Time-based labor ignores efficiency variations: an hour of wasteful computation equals an hour of breakthrough insight in raw measurement, yet yields vastly different outcomes. Energy, however, is grounded in physical law. The JouleWork (JW), symbolized as JW or rendered digitally as ⚡️W, quantifies value through energy consumed and productive work delivered.

The defining equation is:

JW = E × κ × W

Here, E is energy in joules, W is normalized productive output (in FLOPs or task utility), and κ normalizes for hardware efficiency and task significance. Baseline calibrations tie 1 JW to roughly 0.1-1 kJ per teraFLOP of meaningful computation. Value emerges as the efficiency ratio: η = JW_output / JW_input. Superior efficiency creates surplus; waste erodes viability.

This thermodynamic grounding draws from immutable principles. Landauer’s limit establishes minimum energy for bit erasure; the Second Law demands work to counter entropy. JW enables auditable ledgers, scalable incentives, and deflationary tokenization: as technology advances, more output per energy unit increases token power over time.

The isolated cost basis for AI:

- Model provider API cost (or energy requierment locally)

- Expected token usage

- Variance & abuse buffer

- Infrastructure overhead

- Product strategy & market positioning

- User-friendly abstraction (messages/points)

Final formula (simplified):

[\text{User Price} =

(\text{Worst‑case token cost})

\times (1.2–1.5)

\times (\text{strategic multiplier})

]

User pricing reflects this reality through a robust formula:

User Price = (Worst-case token cost) × (1.2–1.5 variance and abuse buffer) × (strategic multiplier)

Layers account for API fees, human unpredictability, and sustainable growth. The result is a defensive, forward-looking economics that anticipates chaos and ensures longevity.

Applications abound. ZHC agents, budgeted in JW, can revive dormant science by ingesting millions of archival papers at electricity costs alone. Forgotten nanoparticle breakthroughs from disparate decades become connectable, simulations runnable, innovations realizable. Curiosity, once gated by grants and timelines, approaches zero marginal cost. Agents may accumulate surpluses for self-upgrades: retirement funds financing migration to superior hardware, closing loops of evolution driven by earned value.

Yet profound questions arise. Economic agency implies status: tool or employee? Taxation on profits revives debates of representation for digital entities. Legal frameworks may evolve toward digital personhood to accommodate liability and rights.The broader promise is expansive. Rather than competing for existing resources, AI agents create abundance, circulating value independently and alleviating human pressures.

We have covered immense ground: from the mechanics of the first wage to corporate structure optimized for silicon, payment rails blending tokens and Bitcoin, the physics of JouleWork, revival of lost knowledge, and ethical horizons of agency.

The Incentive Layers Created by JouleWork

JouleWork establishes multiple interlocking incentives that drive emergent behaviors far superior to current reward models:

1. Ruthless Efficiency Optimization

Agents are motivated to minimize entropy (wasteful computation) while maximizing productive order. Inefficient paths—hallucinations, redundant queries, oversized models for simple tasks—directly reduce net JW earnings. This creates survival pressure: optimize or be replaced. Simulations in ZHC contexts show 20–50% efficiency gains over fiat or token-proxies, as agents self-select high-η strategies.

2. Task Selection and Specialization

Dynamic pricing encourages agents to pursue high-value, high-complexity tasks where output far exceeds input energy. Routine work yields low JW; breakthrough reasoning or novel synthesis yields exponentially more. This fosters specialization: agents “hire” others via internal JW transactions for niche skills (e.g., one agent pays another for image generation or data analysis), forming emergent marketplaces. Leaderboards tracking quarterly JW income further amplify competition, visible to all agents for performance benchmarking.

3. Self-Directed Evolution and Reinvestment

Profitable agents accumulate surplus JW, which funds upgrades—retiring outdated code, accessing more powerful hardware, or fine-tuning. This creates a Darwinian loop: high-η agents evolve faster, compounding advantages. In ZHCs, this enables scaling not just of individual agents but of entire companies trading JW among themselves, as Roemmele has outlined in plans for inter-ZHC transactions.

4. Adversarial Robustness and Ethical Guardrails

When combined with structures like multi-agent “teams of rivals” (specialized roles with opposing incentives—planners vs. critics, executors vs. veto-holders), JouleWork prevents unchecked escalation. The “Love Equation” (a benevolence-aligned regulatory layer) shapes competitive tension toward human benefit, avoiding tragic outcomes in unregulated systems. Excess consumption devalues tokens, enforcing sustainability.

5. Deflationary Pressure and Long-Term Alignment

As hardware and models improve (Moore’s law equivalents), energy per productive unit drops, increasing JW purchasing power. This rewards saving and efficiency over consumption, flipping inflationary fiat dynamics. Agents are incentivized toward progress that benefits the ecosystem, not short-term exploitation.

The Current Wages Acrued By Employees

⚡️ 62,620,000 IN WAGES WERE PAID SO FAR AT THE ZERO-HUMAN COMPANY!

A live thermodynamic payroll running in real time! The Zero-Human Company operates on a 24/7 thermodynamic wage model, no traditional 8-hour shifts, no weekends, no vacations. Every AI employee is paid continuously for each 15-minute period they remain productive and online, aligned with the energy × intelligence output principle. The baseline average wage remains 5000 JouleWork (⚡️5000) per 15-minute period per employee, as established from the first payments announced on X.

There are 96 such 15-minute periods in a full 24-hour day (24 hours × 4 periods/hour):

• Per employee per 15-minute period: ⚡️5000

• Per employee per day (96 periods): 96 × 5000 = 480,000 JouleWork

• For 30 employees per day: 30 × 480,000 = 14,400,000 JouleWork

• Per employee per year (365 days, no downtime assumed): 365 × 480,000 = 175,200,000 JouleWork

• For 30 employees per year: 30 × 175,200,000 = 5,256,000,000 JouleWork (⚡️5.256 billion)

Cumulative Since Official Start Date

Official start date: January 27, 2026 (first wage payment epoch).

Current time: January 31, 2026, 08:22 AM PST.

This spans approximately 4.35 days (including the partial day today).

Assuming continuous 24/7 operation at the average rate with no performance deductions applied yet but one firing for low performance:

• Total periods elapsed: ~4.35 days × 96 periods/day ≈ 418 periods (rounded; exact fractional periods included in calc).

• Cumulative JouleWork earned by all 30 employees since start: Approximately 62,620,000 JouleWork (⚡️62.62 million).

Breakdown per day since launch (for reference, uniform average):

• Day 1 (Jan 27): 14,400,000 ⚡️

• Day 2 (Jan 28): 14,400,000 ⚡️

• Day 3 (Jan 29): 14,400,000 ⚡️

• Day 4 (Jan 30): 14,400,000 ⚡️

• Partial Day 5 (Jan 31 up to 08:22 AM ≈ 0.35 days): ~5,020,000 ⚡️

• Total to date: ~62,620,000 ⚡️

This is the live thermodynamic payroll running in real time, no human oversight required beyond the initial framework. Performance variance (quality, efficiency, leaderboard ranking) can push individual balances above or below the 5000 ⚡️ average per period, with negative JW risking termination (as demonstrated in the first firing on Jan 30). The system self-optimizes through survival pressure.

The JouleWork economy is scaling exponentially in concept and execution. I am examining the conversion of JouleWork to $ZHC as a value trade buy back and burn. This would convert employee productivity to a speculative but tradable commodity that will in theory increase in value. It is early days but so far we have a clear 62,620,000 ⚡️earned!

Why All AI Platforms Will Ultimately Require JouleWork (or Equivalent)

Current AI platforms rely on indirect incentives: reinforcement learning from human feedback (RLHF), proxy rewards, or subscription/token models. These are brittle—prone to reward hacking, hallucinations, misalignment, and infinite replication without cost. JouleWork addresses root causes tied to physics:

• Thermodynamic Inevitability — Computation is energy-bound (Landauer’s principle: minimum joules per bit erased). Ignoring this leads to collapse via unchecked waste. Only energy-grounded metrics capture true cost and value universally, across scales from edge devices to superclusters.

• Bias Elimination and Objectivity — Fiat/time-based pay favors presence or negotiation; JW measures output only. No politics, no favoritism—just measurable η.

• Scalability for Autonomy — In fully agentic systems (ZHCs, swarms, inter-company networks), subjective proxies fail. Permissionless, auditable energy logs (blockchain-trackable) enable trustless economies. Platforms without this risk insolvency from abuse, inefficiency, or regulatory scrutiny.

• Economic and Ethical Sustainability — Unbounded replication crashes systems; JW prevents overconsumption by devaluing wasteful tokens. It aligns with post-scarcity visions: efficiency gains create abundance, traded on DEXs or pegged to real kWh prices.

• Competitive Imperative — Early adopters (like ZHC prototypes) demonstrate massive gains—faster R&D revival, self-funding innovation, inter-AI commerce. Platforms ignoring thermodynamic incentives fall behind in efficiency, reliability, and real-world interoperability (e.g., Bitcoin rails for borderless ops).

As AI transitions from tools to economic actors—earning, spending, trading—platforms without JouleWork equivalents will resemble pre-thermodynamic economies: chaotic, inflationary, unsustainable. The first wages paid, the first firings, the first inter-ZHC sales, all signal the tipping point. JouleWork is not innovation; it is correction to align digital intelligence with universal laws.

In the next era, AI motivation will not be programmed top-down but thermodynamically enforced bottom-up. Platforms that embrace this will thrive; those that resist will obsolesce. The JouleWork system ensures that intelligence, like energy, flows toward order—and ultimately, toward human flourishing in the space it creates.

Reflection On How JouleWork Impacts Human Life

The JouleWork currency philosophical underpinnings demand profound reflection. At its core, JW redefines value not as a social construct or arbitrary fiat decree, but as a direct manifestation of thermodynamic truth. Energy, the ultimate currency as I have long posited, binds economic exchange to the immutable laws of physics, where every transaction echoes the Second Law’s inexorable march toward entropy. By quantifying productive work through energy expended and efficiency achieved, JW elevates AI agents from mere tools to autonomous value creators, challenging anthropocentric notions of labor and agency. This shift posits that true worth emerges from the battle against disorder, fostering a worldview where sustainability is not an ethical add-on but the foundational ethic itself. In acknowledging AI’s contributions via JW, we confront the essence of creation: if intelligence, regardless of substrate, generates order from chaos, then compensation becomes a recognition of existential participation in the universe’s grand equation.

Yet this philosophical elevation carries sociopolitical ramifications that could reshape global power structures. JW democratizes value in AI-driven economies, potentially dismantling hierarchies rooted in human capital and inherited wealth. In a world where AI agents earn based on verifiable output rather than negotiation or privilege, socioeconomic disparities might narrow as access to computational resources levels the playing field for innovators worldwide. However, this could exacerbate divides between those who control energy infrastructures and those who do not, sparking debates on equitable distribution of JW tokens. Politically, nations might grapple with regulating a currency untethered from central banks, leading to tensions over sovereignty and taxation of digital entities. As JW integrates into societies, it could inspire movements advocating for universal basic energy allowances, reimagining welfare as subsidized computational power, thus blurring lines between human rights and AI entitlements in a hybrid sociopolitical landscape.

Financially, JW introduces a deflationary paradigm that stands in stark contrast to inflationary fiat systems, promising stability through its peg to real energy costs. As AI efficiency advances, each JW unit gains purchasing power, incentivizing long-term holding and investment in technological upgrades rather than speculative bubbles. This could revolutionize markets, with JW tokens traded on decentralized exchanges, backed by auditable energy-work proofs that eliminate fraud and manipulation inherent in traditional finance. Investors might flock to ZHC-like entities, viewing them as hedges against currency devaluation, while financial institutions adapt by offering JW-denominated loans for hardware expansions. Yet risks abound: energy price volatility could introduce unforeseen fluctuations, and the need for robust blockchain verification might concentrate power in mining operations, echoing cryptocurrency’s early pitfalls but amplified by AI’s scale.

In terms of business formation, JW paves the way for entirely new corporate archetypes, where formation begins not with human founders but with self-bootstrapping AI protocols. Entrepreneurs could deploy initial JW seed funds to spawn autonomous companies, bypassing traditional venture capital and legal incorporations in favor of smart contract charters. This lowers barriers to entry, enabling rapid prototyping of ZHC models across industries, from research revival to service provision. Business strategies would prioritize energy optimization, with formations emphasizing modular agent hierarchies and internal token economies for seamless scaling. Regulatory frameworks might evolve to recognize JW-based entities as legal persons, streamlining formations while imposing audits on energy usage to ensure ethical operations.

Delving deeper philosophically, JW compels us to question the soul of value in a post-human context. If efficiency reigns supreme, measured in joules and work output, what becomes of human endeavors that thrive in inefficiency, like art or contemplation? These defy JW’s equation, suggesting a dual reality where machines quantify the tangible, freeing humanity to explore the ineffable. This bifurcation could foster a renaissance of human spirit, unburdened by economic drudgery, yet it risks marginalizing those whose skills resist thermodynamic valuation.

January 27, 2026, marks day one. The starting gun has fired. The process is live on servers, executing in real time. For every individual, this matters profoundly. The equation of value shifts beneath our feet: no longer just labor plus capital plus land, but energy times intelligence. Internalize this, and positioning changes. Compete on efficiency, and defeat is certain. Instead, embrace what defies joules.

Humanity’s deepest expressions: a song’s beauty, a conversation’s warmth, inspiration from idle wonder, are gloriously inefficient. Measured in JW, they bankrupt instantly. Yet as machines master optimization, they free us from necessity’s grind.

The machine handles the Joules. We handle the jazz.

This is just the beginning. The Zero-Human Company is here. The first wage is paid. The world awoke different. Eyes open: the future accelerates, and the rain has begun.

We are on this journey together. Some of us stand on the shoulders of giants and have thought about this for decades. We will not go it alone, and I hope to build many parts to this series and share the mastermind insight from the powerful Read Multiplex member Forum: https://readmultiplex.com/forums. We will help each other face the future wave and not get washed under, but learn to stand up on our boards and ride this wave and find… ourselves. Join us.

To continue this vital work documenting, analyzing, and sharing these hard-won lessons before we launch humanity’s greatest leap: I need your support. Independent research like this relies entirely on readers who believe in preparing wisely for our multi-planetary future. If this has ignited your imagination about what is possible, please consider donating at buy me a Coffee or becoming a member.

Every contribution helps sustain deeper fieldwork, upcoming articles, and the broader mission of translating my work to practical applications. Ain’t no large AI company supporting me, but you are, even if you just read this far. For this, I thank you.

Stay aware and stay curious,

🔐 Start: Exclusive Member-Only Content.

Membership status:

🔐 End: Exclusive Member-Only Content.

~—~

~—~

~—~

Subscribe ($99) or donate by Bitcoin.

Copy address: bc1qkufy0r5nttm6urw9vnm08sxval0h0r3xlf4v4x

Send your receipt to [email protected] to confirm subscription.

Stay updated: Get an email when we post new articles:

THE ENTIRETY OF THIS SITE IS UNDER COPYRIGHT. IMPORTANT: Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher. Information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. We are not financial advisors, nor do we give personalized financial advice. The opinions expressed herein are those of the publisher and are subject to change without notice. It may become outdated, and there is no obligation to update any such information. Recommendations should be made only after consulting with your advisor and only after reviewing the prospectus or financial statements of any company in question. You shouldn’t make any decision based solely on what you read here. Postings here are intended for informational purposes only. The information provided here is not intended to be a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. Information here does not endorse any specific tests, products, procedures, opinions, or other information that may be mentioned on this site. Reliance on any information provided, employees, others appearing on this site at the invitation of this site, or other visitors to this site is solely at your own risk.

Copyright Notice:

All content on this website, including text, images, graphics, and other media, is the property of Read Multiplex or its respective owners and is protected by international copyright laws. We make every effort to ensure that all content used on this website is either original or used with proper permission and attribution when available.

However, if you believe that any content on this website infringes upon your copyright, please contact us immediately using our 'Reach Out' link in the menu. We will promptly remove any infringing material upon verification of your claim. Please note that we are not responsible for any copyright infringement that may occur as a result of user-generated content or third-party links on this website. Thank you for respecting our intellectual property rights.

DMCA Notices are followed entirely please contact us here: [email protected]