The Long Cold Winter Ahead.

The Convergence Of A Perfect Financial Storm.

The last half a decade has had no known comparison in modern history. Perhaps World War II may compare in some cosmetic ways and some psychological ways. In many ways we are in not just a “war” but many wars, some obvious and some obscured. Clouding recognition is Information Overload (that issue will be explored in a future article) and the binary polarization of every subject to the point that there can be no true rational explorations and discussions. We are all victims, and to a greater degree we are all “guilty”.

One of the wars all of us face is economic. This transcends all cultures and income levels. However, it is particularly most impactful to the middle income through the lowest income. The perfect storm economic, but it is based on three issues:

- War

- Inflation

- Pandemic

- Energy Collapse

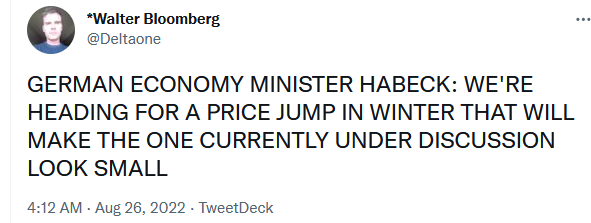

The pandemic distorted the economy in a way that may take 50 years for some to fully understand, if ever. Inflation is a reality (this is obvious and not “political”), The collapse of the entire energy market during the pandemic start in 2020 has not fully recovered (not speaking of stock prices) from favored “renewables” to disfavored “old energy”. Some may argue just the inflation/energy collapse are tied together. This is true in one sense, but in a long term sense they have far different life paths. However, they do have to cross life paths often and count on each other. Finally, with war comes a spectacular amount of suffering, pain and confusion. The consequences of war means there will be economic constraints, and this has a massive impact on this perfect storm. This all adds up to a very long cold winter ahead.

In the member exclusive Read Multiplex article, I explored the Battery Agenda in December 2020 that was ahead, https://readmultiplex.com/2021/01/27/lithium-nickel-cobalt-and-graphite-and-the-next-48-months/. I presented how the “rare-earth” minerals would become a massive opportunity for just about anyone. And in 2022 some recommendations tripled and may go one to do far better.

Everything in our life is a form of energy. Life is energy. Work, of course, is energy. We flip on a light switch, and most of us forget the long chain of connections that illuminated the light. To most of us here, this may not be the case. A few generations have been through the educational systems and exit with less knowledge of the mechanics of life than the 1900s-1950s. Thus, it is easy to become susceptible to the pronouncements and ideas from the popular world. This situation has created an environment that is highly polarized and nearly impossible to have practical clarity. This article will not give clarity to this situation. I will not be addressing the very real philosophic issues humanity faces in this article. Know that I do deeply understand them, and there are no simple solutions.

This article will address something very real to your life at this moment. It is very real at this moment that everything is escalating in costs. It is very real that everything has been skewed by a pandemic. Furthermore, it is very real that energy costs will impact every life and every company, on top of the inflation.

This article and a few more I will write will be addressing your financial life, at this moment. This is not financial advice, I am not a licensed stockbroker, I do not recommend you invest in any particular stocks, and it is vitally important to know what gains took place in the past do not guarantee any gains in the future. It is best to assume I do own stocks I speak about. I strongly advise working with a trusted license professional and to only invest funds you absolutely can 100% lose.

The future ahead, in a very pragmatic sense, you are now paying a very large hidden tax on the rising prices of energy. Conserve, shift and do all you can to help change this. But what if you could gain back some of the money you are spending on the rise in energy costs? I have had a simple rule that has guided many of my investments: “If you use a product or service, invest in it if you can. Own the company”. I see this as a “Rebate System” where some of my purchases are rebated back to me as an “owner”. It is really this simple. So with energy, what can you do on a broad scale as it impacts all products and services?

On August 25th, 2022 I posted this Tweet. It of course was a free insight, much like the free insight I made in 2021 on Lithium. I feel strongly that this meets the idea of owning what services and products you use. The reason is simple, this Exchange Traded Fund (EFT), a basket of Energy Stocks and related dividends. The XLE EFT is not the only one in this class, there are more. However, this is a good start to research.

In this members only article, we will explore pragmatic things you can do today that can help you face what is ahead.This perfect storm and the long cold winter, as terrible as it will be to all the world, nothing I can write about will take away from how this will impact your life and the people you love. However, perhaps for the first time in many lives, you may be able to have a hedge to not only survive in the chaos ahead, but perhaps thrive. There will be a massive wealth transfer ahead that will impact everyone in the world, it is my hope this is one of the ways you can get something you will lose, back.If you are a member, thank you. To become a member, please click on the link below and join us.

🔐 Start: Exclusive Member-Only Content.

Membership status:

🔐 End: Exclusive Member-Only Content.

~—~

~—~

~—~

[crypto-donation-box type=”tabular”]Subscribe ($99) or donate by Bitcoin.

Copy address: bc1q9dsdl4auaj80sduaex3vha880cxjzgavwut5l2

Send your receipt to Love@ReadMultiplex.com to confirm subscription.

IMPORTANT: Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher. Information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. We are not financial advisors, nor do we give personalized financial advice. The opinions expressed herein are those of the publisher and are subject to change without notice. It may become outdated, and there is no obligation to update any such information. Recommendations should be made only after consulting with your advisor and only after reviewing the prospectus or financial statements of any company in question. You shouldn’t make any decision based solely on what you read here. Postings here are intended for informational purposes only. The information provided here is not intended to be a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. Information here does not endorse any specific tests, products, procedures, opinions, or other information that may be mentioned on this site. Reliance on any information provided, employees, others appearing on this site at the invitation of this site, or other visitors to this site is solely at your own risk.

Copyright Notice:

All content on this website, including text, images, graphics, and other media, is the property of Read Multiplex or its respective owners and is protected by international copyright laws. We make every effort to ensure that all content used on this website is either original or used with proper permission and attribution when available.

However, if you believe that any content on this website infringes upon your copyright, please contact us immediately using our 'Reach Out' link in the menu. We will promptly remove any infringing material upon verification of your claim. Please note that we are not responsible for any copyright infringement that may occur as a result of user-generated content or third-party links on this website. Thank you for respecting our intellectual property rights.

Great article, Brian. Agree with your thesis but curious on whether you see nuclear energy becoming a viable (and more politically popular) solution as the crisis unfolds? And if not, why?

Best,

Mitch

Mitch, thanks for asking. Indeed I do. I will be posting a few articles on this subject soon. From an investment aspect however, it is early even though there may be some opportuneies.

Understood. Look forward to reading. Thanks

I would gladly invest in nuclear energy.

Buther there are Politicians who are making tons of money from green energy and/or gas pipelines with the power to wield paperwork like a weapon.

(Think of a lawyer buried in crates of documents by the opposing counsil.)

I’ve chatted with someone in the industry and they said that they have at least as many people working on regulatory requirements as they have workers doing actual work on the plant.

But if there are countries that allow nuclear energy and maybe even small modular reactors to flourish I’ll be glad to know and bet on their success.